Tesla Charging Station Tax Credit . updated 11:46 am pdt, september 18, 2024. Washington (ap) — the biden administration is moving to clarify. the irs and treasury department proposed rules wednesday for the alternative fuel vehicle refueling property tax credit. the us treasury’s ev charger tax credit (which is claimed on irs form 8911) is limited to $1,000 for individuals claiming. essentially, if you install a home ev charging station, the tax credit is 30% of the cost of hardware and installation, up to $1,000. you may get federal tax credit for your home ev charger. Also, beginning last year the ev. Department of the treasury and internal revenue service (irs) released additional. the section 30c provision provides a tax credit for up to 30% of the cost of installing qualified alternative fuel vehicle. During the 2023 tax season, taxpayers are eligible for a credit of.

from ar.inspiredpencil.com

Department of the treasury and internal revenue service (irs) released additional. essentially, if you install a home ev charging station, the tax credit is 30% of the cost of hardware and installation, up to $1,000. you may get federal tax credit for your home ev charger. Also, beginning last year the ev. Washington (ap) — the biden administration is moving to clarify. During the 2023 tax season, taxpayers are eligible for a credit of. the us treasury’s ev charger tax credit (which is claimed on irs form 8911) is limited to $1,000 for individuals claiming. the section 30c provision provides a tax credit for up to 30% of the cost of installing qualified alternative fuel vehicle. the irs and treasury department proposed rules wednesday for the alternative fuel vehicle refueling property tax credit. updated 11:46 am pdt, september 18, 2024.

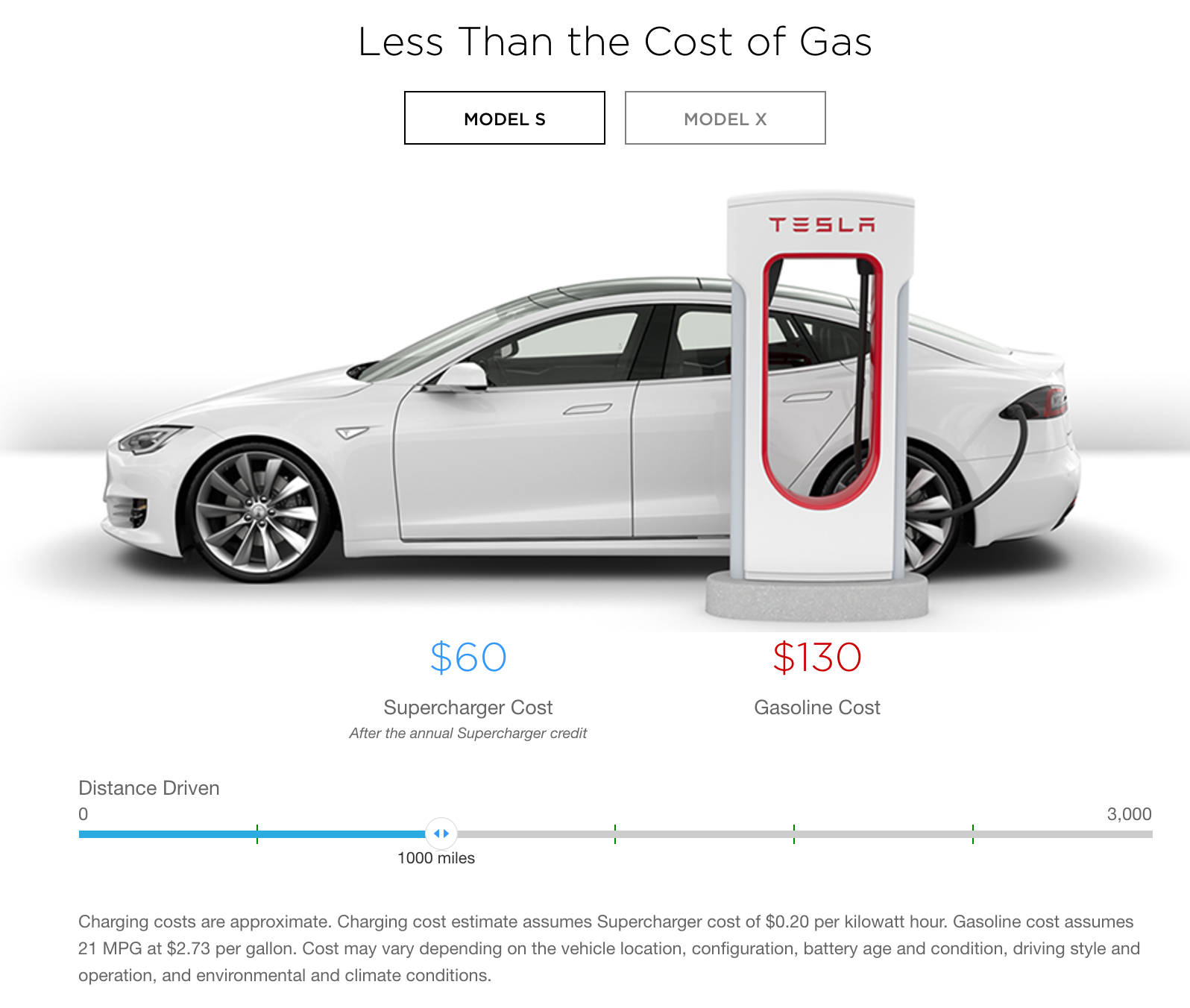

Tesla Charging Rates

Tesla Charging Station Tax Credit Washington (ap) — the biden administration is moving to clarify. Also, beginning last year the ev. Department of the treasury and internal revenue service (irs) released additional. the us treasury’s ev charger tax credit (which is claimed on irs form 8911) is limited to $1,000 for individuals claiming. you may get federal tax credit for your home ev charger. During the 2023 tax season, taxpayers are eligible for a credit of. the irs and treasury department proposed rules wednesday for the alternative fuel vehicle refueling property tax credit. essentially, if you install a home ev charging station, the tax credit is 30% of the cost of hardware and installation, up to $1,000. updated 11:46 am pdt, september 18, 2024. Washington (ap) — the biden administration is moving to clarify. the section 30c provision provides a tax credit for up to 30% of the cost of installing qualified alternative fuel vehicle.

From www.youtube.com

Tesla & GM Due To Regain 7500 Tax Credit, Discounts For Used EVs and Tesla Charging Station Tax Credit you may get federal tax credit for your home ev charger. Washington (ap) — the biden administration is moving to clarify. the us treasury’s ev charger tax credit (which is claimed on irs form 8911) is limited to $1,000 for individuals claiming. the irs and treasury department proposed rules wednesday for the alternative fuel vehicle refueling property. Tesla Charging Station Tax Credit.

From engineercalcs.com

How Much Does It Cost to Charge a Tesla? Engineer Calcs Tesla Charging Station Tax Credit the section 30c provision provides a tax credit for up to 30% of the cost of installing qualified alternative fuel vehicle. the irs and treasury department proposed rules wednesday for the alternative fuel vehicle refueling property tax credit. During the 2023 tax season, taxpayers are eligible for a credit of. updated 11:46 am pdt, september 18, 2024.. Tesla Charging Station Tax Credit.

From www.carshtuff.com

How Do Tesla Charging Stations Work? CarShtuff Tesla Charging Station Tax Credit the section 30c provision provides a tax credit for up to 30% of the cost of installing qualified alternative fuel vehicle. Department of the treasury and internal revenue service (irs) released additional. you may get federal tax credit for your home ev charger. Also, beginning last year the ev. the us treasury’s ev charger tax credit (which. Tesla Charging Station Tax Credit.

From www.torquenews.com

Tesla Finally Offering the 7,500 EV Tax Credit As An Instant Rebate At Tesla Charging Station Tax Credit updated 11:46 am pdt, september 18, 2024. essentially, if you install a home ev charging station, the tax credit is 30% of the cost of hardware and installation, up to $1,000. the section 30c provision provides a tax credit for up to 30% of the cost of installing qualified alternative fuel vehicle. the irs and treasury. Tesla Charging Station Tax Credit.

From www.evconnect.com

All About Tax Credits for Installing Electric Vehicle Charging Stations Tesla Charging Station Tax Credit Also, beginning last year the ev. Washington (ap) — the biden administration is moving to clarify. During the 2023 tax season, taxpayers are eligible for a credit of. the section 30c provision provides a tax credit for up to 30% of the cost of installing qualified alternative fuel vehicle. you may get federal tax credit for your home. Tesla Charging Station Tax Credit.

From www.instituteforenergyresearch.org

Tax Credits Are Expiring for Tesla and GM IER Tesla Charging Station Tax Credit the section 30c provision provides a tax credit for up to 30% of the cost of installing qualified alternative fuel vehicle. During the 2023 tax season, taxpayers are eligible for a credit of. essentially, if you install a home ev charging station, the tax credit is 30% of the cost of hardware and installation, up to $1,000. . Tesla Charging Station Tax Credit.

From www.sdpuo.com

The Truth About Tesla Charging Stations Costs and Benefits Explained Tesla Charging Station Tax Credit Department of the treasury and internal revenue service (irs) released additional. During the 2023 tax season, taxpayers are eligible for a credit of. Washington (ap) — the biden administration is moving to clarify. the section 30c provision provides a tax credit for up to 30% of the cost of installing qualified alternative fuel vehicle. the irs and treasury. Tesla Charging Station Tax Credit.

From www.freightwaves.com

Today’s Pickup Tesla's new charging stations can charge cars in around Tesla Charging Station Tax Credit updated 11:46 am pdt, september 18, 2024. Also, beginning last year the ev. the irs and treasury department proposed rules wednesday for the alternative fuel vehicle refueling property tax credit. the us treasury’s ev charger tax credit (which is claimed on irs form 8911) is limited to $1,000 for individuals claiming. Washington (ap) — the biden administration. Tesla Charging Station Tax Credit.

From www.chargepoint.com

How to Claim Your Federal Tax Credit for Home Charging ChargePoint Tesla Charging Station Tax Credit the irs and treasury department proposed rules wednesday for the alternative fuel vehicle refueling property tax credit. the section 30c provision provides a tax credit for up to 30% of the cost of installing qualified alternative fuel vehicle. During the 2023 tax season, taxpayers are eligible for a credit of. Also, beginning last year the ev. the. Tesla Charging Station Tax Credit.

From www.slideteam.net

Ev Charging Station Tax Credit In Powerpoint And Google Slides Cpb Tesla Charging Station Tax Credit essentially, if you install a home ev charging station, the tax credit is 30% of the cost of hardware and installation, up to $1,000. the irs and treasury department proposed rules wednesday for the alternative fuel vehicle refueling property tax credit. you may get federal tax credit for your home ev charger. Also, beginning last year the. Tesla Charging Station Tax Credit.

From www.autoevolution.com

How Tesla Bent IRA Rules To Get Full 7,500 Tax Credit for Model 3 RWD Tesla Charging Station Tax Credit you may get federal tax credit for your home ev charger. the us treasury’s ev charger tax credit (which is claimed on irs form 8911) is limited to $1,000 for individuals claiming. essentially, if you install a home ev charging station, the tax credit is 30% of the cost of hardware and installation, up to $1,000. Also,. Tesla Charging Station Tax Credit.

From illumination.duke-energy.com

Need help buying an EV? Here's how to navigate the tax credits Duke Tesla Charging Station Tax Credit the section 30c provision provides a tax credit for up to 30% of the cost of installing qualified alternative fuel vehicle. the us treasury’s ev charger tax credit (which is claimed on irs form 8911) is limited to $1,000 for individuals claiming. essentially, if you install a home ev charging station, the tax credit is 30% of. Tesla Charging Station Tax Credit.

From garagefixrsklubjh.z22.web.core.windows.net

Tesla Charging Stations For Other Evs Tesla Charging Station Tax Credit the section 30c provision provides a tax credit for up to 30% of the cost of installing qualified alternative fuel vehicle. the irs and treasury department proposed rules wednesday for the alternative fuel vehicle refueling property tax credit. updated 11:46 am pdt, september 18, 2024. you may get federal tax credit for your home ev charger.. Tesla Charging Station Tax Credit.

From insideevs.com

Tesla Model 3 RWD, Long Range Will Lose The Entire EV Tax Credit In 2024 Tesla Charging Station Tax Credit Department of the treasury and internal revenue service (irs) released additional. During the 2023 tax season, taxpayers are eligible for a credit of. Also, beginning last year the ev. the irs and treasury department proposed rules wednesday for the alternative fuel vehicle refueling property tax credit. you may get federal tax credit for your home ev charger. Washington. Tesla Charging Station Tax Credit.

From www.eduvast.com

Tesla Model 3 Tax Credit Check Your Eligibility Tesla Charging Station Tax Credit the us treasury’s ev charger tax credit (which is claimed on irs form 8911) is limited to $1,000 for individuals claiming. updated 11:46 am pdt, september 18, 2024. you may get federal tax credit for your home ev charger. During the 2023 tax season, taxpayers are eligible for a credit of. the section 30c provision provides. Tesla Charging Station Tax Credit.

From www.vvdailypress.com

Tesla charging hub in Barstow to have 100 stations, most in US Tesla Charging Station Tax Credit During the 2023 tax season, taxpayers are eligible for a credit of. the irs and treasury department proposed rules wednesday for the alternative fuel vehicle refueling property tax credit. you may get federal tax credit for your home ev charger. the us treasury’s ev charger tax credit (which is claimed on irs form 8911) is limited to. Tesla Charging Station Tax Credit.

From uat-new.nysscpa.org

IRS Issues Guidance on Electric Vehicle Charging Station Tax Credits Tesla Charging Station Tax Credit the irs and treasury department proposed rules wednesday for the alternative fuel vehicle refueling property tax credit. During the 2023 tax season, taxpayers are eligible for a credit of. essentially, if you install a home ev charging station, the tax credit is 30% of the cost of hardware and installation, up to $1,000. the section 30c provision. Tesla Charging Station Tax Credit.

From www.trendradars.com

Tax credits for electric vehicles are coming. How will they work Tesla Charging Station Tax Credit Department of the treasury and internal revenue service (irs) released additional. Washington (ap) — the biden administration is moving to clarify. During the 2023 tax season, taxpayers are eligible for a credit of. you may get federal tax credit for your home ev charger. the irs and treasury department proposed rules wednesday for the alternative fuel vehicle refueling. Tesla Charging Station Tax Credit.